When you offer somebody a ‘Power of Attorney’ (POA) you are giving them ‘company authority:’ the power to act in your name. This indicates that they can have the legal power to act as if they were you and do all sorts of important stuff on your behalf.

Please proceed with care: A POA can be absolutely essential or extremely risky or both! Your assigned Agent or ‘Attorney-in-Fact’ can authorize records that obligate you to points. They can relocate your cash where they such as. They have the authority to buy and sell residential or commercial properties in your name – and a lot more, relying on packages you might have hastily ticked on a California Power of Attorney type.

Consider a POA like a potent prescription medicine. Made use of properly, and in the best dosage, it can obtain you with challenging times. But if used improperly, mistreated, or given up too expensive a dosage, a POA can do irreparable injury.

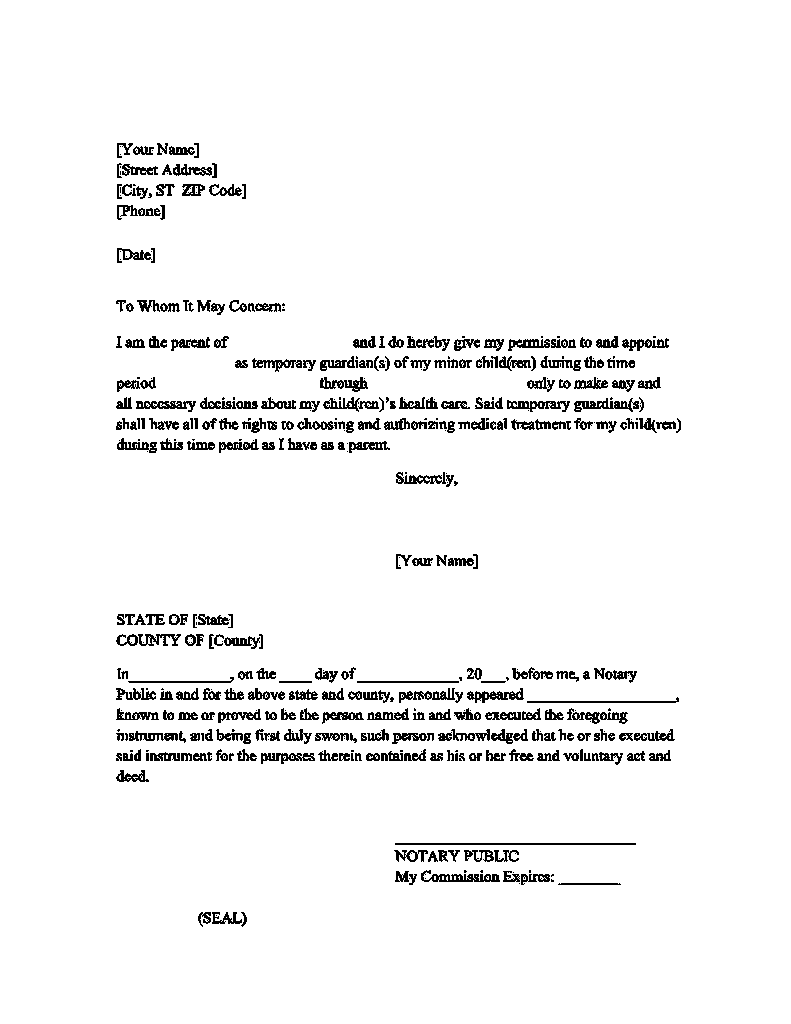

Let’s begin by explaining that a ‘Power of Attorney’ has nothing to do with lawyers. It is a notepad, often a 2 or three-page type quickly downloaded and install from the net (see listed below), which you sign in front of a notary.read about it more details about illinois minor child power of attorney from Our Articles In that paper, you appoint specific powers to your Agent. Other ‘attorney composed’ POAs can be more than 30 pages long. Legally, these powers are referred to as ‘powers of attorney,’ however your Representative is not called for to have any legal training, a family connection, or various other functions in your Estate.

As soon as you sign a General POA, your Agent can legally act in your name without your understanding – and without compulsory oversight of any kind of court, governmental agency, Bar Association, or other institution.

We highly recommend seeking advice from a qualified attorney before assigning powers of attorney. Contact CunninghamLegal for comprehensive Estate Planning in The Golden State.

Senior Citizen Power of Attorney Scams

Senior people can make the error of finalizing over Powers of Attorney to employed caretakers, undependable next-door neighbors, ‘brand-new friends,’ and others that ought to never ever be provided such powers. This occurs a lot that many states have actually composed Financial Elder Misuse regulations to protect senior citizens and dependent grownups.

Certainly, individuals leaving jail are frequently advised to become caregivers to the elderly since the elderly, or their enjoyed ones, commonly do not demand history checks be completed. Captivating previous convicts may do well in getting a baffled elderly to authorize a POA giving the caretaker full powers over their finances. Various other relative commonly do not know this has occurred until it is far too late and possessions have actually been drained pipes.

Theoretically, your Representative is legitimately obliged as a fiduciary to act just on your behalf, however in truth, because nobody is watching, they can pretty much do as they please. In my company, we have sometimes seen elder fraud carried out by individuals with Powers of Lawyer.

Grandmother’s New Helper Assists Herself to a POA

Granny wants to live alone, so the youngsters strive to obtain her a complete or part-time assistant to supply support. They call a number of recommendations provided by Lucy and hear just beautiful testimonials over the phone. Lucy is a fascinating young woman, she takes care of your house, helps Grandma with her personal demands, and throughout 6 months or two, Grandma begins to really feel real love for her. Lucy starts running duties for Grandmother to the shop and perhaps leaves deposits at the bank. Then she starts assisting pay her expenses. Little by little, Grandmother’s children start paying much less and much less attention to what’s happening, since Lucy is doing such a great task.

One day, Lucy goes on the internet and downloads a Durable Power of Attorney kind and slides it under Grandma’s nose. She’s currently marked off all the boxes and filled out all the details. She’s likewise brought along a deceitful notary. ‘Could you authorize this for me? After that I can help pay the bills and things for you a lot extra easily.’ Granny grins at the procedure of having the notary present, however gladly indications.

The kids find out about none of this. However two months later Grandmother’s savings account reads $0. Her investments have actually been liquidated and moved to multiple accounts, which were then drained and shut. ‘Lucy’ has gone away. Possibility of recuperation? Nil.

This is not a rare incident. Yet you require to be cautious, not afraid: POAs can be used permanently, not just bad.

Do I Need a Power of Attorney in Case I Get Sick?

Despite the dangers in a POA, you should think about creating a Durable Power of Attorney calling an absolutely trusted person in case you end up being mentally incapacitated or otherwise unable to act upon your own part. Certainly, in most cases, despite the dangers, the majority of people select to develop a Durable Power of Attorney as part of their Living Trust-centered estate plan.

Without a POA in position, that would pay your expenses? Who would certainly pay your tax obligations? Who would certainly authorize your tax return? That would manage the thousand various other legal and monetary details you would be not able to handle yourself?

You could be thinking ‘does not my living trust fund take care of all that?’ The answer is no. Your trustee can sign your specific tax return, however can not take care of your individual retirement account and 401(k) while you live, and typically can not handle possessions that are not in your living depend on.

Any individual over 18 should think about authorizing a The golden state Resilient Power of Attorney, but take the time to recognize the issues completely, make use of the right sort of POA, with the best sort of limits, include close household in your decision, and obtain expert recommendations before you authorize anything.

Above all, make sure you totally recognize and fully trust fund the individual you assign as your Agent.

Do I Required an Attorney to Create Powers of Lawyer?

Simply mentioned, you should always look for lawful counsel prior to authorizing an important, effective document like a Long lasting Power of Attorney.

This write-up notes the various kinds of Powers of Lawyer in The golden state, makes clear the partnership of POAs to Trust funds, describes the crucial difference between a POA Representative and a Trustee – then spends time showing how a Power of Attorney is various from a Conservatorship for a senior or incapacitated person.

Along the road, I hope you will recognize that these vital papers, legal partnerships, and life decisions should not be approached as diy tasks. Without certified expert advice from a professional estate lawyer, it’s much too simple to make a mistake that can have awful repercussions on your own and your enjoyed ones.

At my company, CunninghamLegal, we collaborate with households to create the right Powers of Attorney and various other critical Estate Planning documents, tailored to private life scenarios. We have workplaces throughout California with professional estate attorneys and we invite you to call us for aid and advice as you approach these vital problems.

Financial Power of Attorney California: What Are the Various Types of Powers of Attorney?

There are 4 standard kinds of Financial Power of Attorney – and a fifth kind just for health care choices. It’s vital to understand the differences and select the right course – then review that path consistently.

The ‘Attire Statutory Form Power of Attorney’ (see listed below for The golden state’s variation) is a state-specific kind that is established by a state legislature and is normally easily readily available online. These have typical, state-approved, statutory language. However, in many cases, I advise making use of an attorney to help you complete the type (or prepare a custom-made Power of Attorney which includes specific, personalized language) because these kinds are confusing and regularly are incorrectly completed.

- What is a General Power of Attorney? A General Power of Attorney normally starts as soon as it is authorized and offers wide powers figured out in the file, frequently by checkboxes. If I downloaded a General POA form from the net, wrote in your name as my Agent, checked all the boxes, and signed it in front of a notary, you would instantly become my ‘Attorney-in-Fact,’ able to drain my bank account, market my residence, and take out a car loan in my name. I would genuinely be providing you the tricks to my kingdom. Unless it was a ‘Long lasting’ POA, however, the document would certainly become invalid as soon as I ended up being incapacitated. This can create considerable complication, which is why most individuals create a Resilient Power of Attorney also while they are well.

- What is a Durable Power of Attorney (DPOA)? A Long Lasting Power of Attorney can be ‘General’ or restricted in scope, however it stays essentially (long lasting) also after you end up being incapacitated. A Sturdy Power of Attorney is one of the most usual kind of POA that people indicator as part of their Estate Planning because they feel they need to offer a person the power to handle their affairs if they become incapable to substitute themselves. If you don’t have a Resilient POA in position and you become incapacitated, your family might have to go to court to have themselves or an additional appointed as a ‘Guardian’ or ‘Conservator’ for you (extra on that particular below). This is a pricey and lengthy procedure. In California, a lot of conservatorships go beyond $10,000 in fees and costs in the first year alone. Due to the fact that they are the most usual instruments, the mass of this short article will certainly deal with Sturdy Powers of Lawyer.

- What is a Springing Durable Power of Attorney? A Springing Resilient POA is similar to a normal Sturdy Power of Attorney, however ‘springtimes’ right into result either when you end up being incapacitated (in which situation the POA discontinues to function if and when you recover) or when you authorize a Certification of Consent that triggers the POA. A Springing POA sounds safer and better theoretically, yet in practice it can bring about troubles since your Agent will certainly need to obtain a ‘resolution’ of your incapacity from a doctor before using their representative powers. This can be additionally made complex by HIPAA privacy regulations, and there’s constantly the inquiry of what, exactly, constitutes inability. Will others in the family agree? For these factors, most individuals simply give a Durable Power of Attorney, efficient when signing, to someone they deeply count on, or make use of the Certification of Permission.

- What is Special Power of Attorney or Limited Power of Attorney in California? A Restricted or Special POA allows your attorney-in-fact (Representative) to act just in extremely certain circumstances, for highly-specific functions, or a minimal duration. For example, if you require someone to substitute you in a legal matter while you get on trip, you could give them an Unique Power of Attorney just for that activity. Or you can offer a service companion the right to authorize documents in your name while you go through a serious clinical treatment. You need to absolutely see a certified lawyer to prepare such a POA.

- What is a Resilient Power of Attorney for Medical care? In this specific POA for Healthcare you provide somebody the power to make clinical decisions (not monetary or various other decisions) for you when you are incapable to make those choices on your own. Some other names for comparable files are ‘Medical POA,’ ‘Health Care Proxy,’ or ‘Advancement Health Care Regulation.’ In some states, like California, health care POAs can be incorporated with a ‘Living Will certainly’ which lays out your wishes for when you are gravely ill and near the end of life.

No comment yet, add your voice below!